The pro-cyclical elements of the Trump trade all suffered a serious setback this week amid a tariff-induced growth scare. Not to be deterred, Trump doubled down on the trade war, with another 10% tariff hike on China, 25% tariffs on Canada and Mexico from 4 March, threatened 25% tariffs on the EU and across the board reciprocal tariffs from 2 April.

The S&P Global services PMI collapsed into contractionary territory in January, while the Michigan and Conference Board consumer sentiment readings were predictably awful. While I would not normally put much store in 'soft' sentiment indicators such as these, they are all too consistent with what financial market prices are telling us. Equity market sentiment has soured, not least for Trump trade stocks such as Tesla and Palantir, along with crypto. The US 10-year Treasury yield dipped below its November election day levels and the 10-year/3-month term spread has even re-inverted.

The US House of Representatives passed a budget resolution that adds $2.8 trillion to the budget deficit by 2034, which makes a nonsense of Treasury Secretary Bessent's hopes for lower US Treasury yields on the back of fiscal consolidation. As argued in this space previously, growth expectations will dominate US Treasury yields, even as the US fiscal position deteriorates, and US Treasuries are already in growth scare mode.

The resilience of the USD

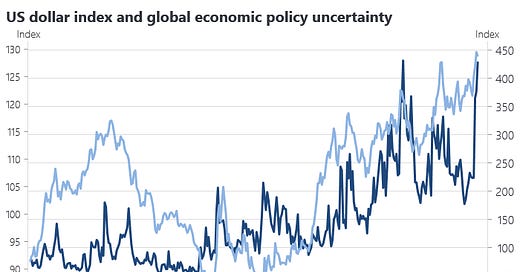

The USD is likely to remain the most resilient element of the post-election Trump trade, with policy uncertainty and the currency offset to new tariffs both supportive factors.

Paul Blustein just came out with his new book King Dollar: The Past and Future of the World's Dominant Currency. It makes the conventional case for US dollar dominance, although as the author readily conceded in a thread on Bluesky, that case looks somewhat less convincing given post-election developments in Washington. Blustein's conclusion favouring USD dominance was subject to the proviso 'barring catastrophic missteps by the US government.' Such missteps must now be judged far more likely.

We have previously noted the tension between the administration's desire to maintain USD dominance, while also wanting to promote a weaker exchange rate and lower Treasury yields, even as administration policy conspires to place upward pressure on the exchange rate. In my own contribution to the literature on the role of the USD, I made the point that the dollar's role in global finance is independent of the USD exchange rate. A weaker currency is perfectly consistent with USD dominance. The floating exchange normally helps the US economy adjust to shocks and a weaker exchange rate can contribute to economic resilience.

Given the administration's preference for a weaker exchange rate, it would not be surprising to see intervention on the exchange rate at some point. So far, the administration is following the 'tariffs first' approach advocated by Stephen Miran. But since tariffs will put upward pressure on the exchange rate while failing to 'balance' trade flows, it would not be surprising to see the US resort to foreign exchange market intervention, including capital controls or taxes on foreign capital inflows.

Stablecoins and offshore dollar liquidity

As Bob McCauley wrote this week, a tax on foreign holdings of US Treasuries would simply lead to the accumulation of USD liquidity offshore, as well as increased demand for securities with perceived US government guarantees like agency debt.

Ironically, the administration is also seeking to promote the development of US dollar stablecoins, while threatening tariffs against countries that develop their own CBDCs. I have long maintained that stablecoins are the logical end state for crypto, since they combine the technological advantages of distributed ledger technology with the benefits of fiat. (As an aside, there is not much point to holding crypto as a distinct asset class if fiat parity is the end state). But stablecoins also have the potential to create offshore pools of US dollar liquidity outside the US regulatory perimeter, enabling US dollar payments without involving the US government regulated USD clearing system. This in turn would limit the ability of the US government to weaponise the payments system, an important instrument of US foreign policy.

Rather than ending US dollar dominance, the administration's attempts at economic coercion coupled with the promotion of crypto might lead to creation of a USD denominated, crypto-based end-run around the USD payments system, much like the Eurodollar market previously enabled an end-run around US financial regulation. It should be recalled that the Eurodollar market had its origins in USD deposits with the Moscow Narodny Bank in London to avoid the US government's sanctions on the former Soviet Union. In this scenario, the USD would remain as important as ever in international finance, but less subject to US government control. It is also worth recalling that most USD cash already circulates outside the US.

In my own paper on the subject, I argued for the irrelevance of foreign central bank official reserve asset holdings of US dollars to the dollar's role. That role and the USD exchange rate is ultimately a function of foreign demand for US goods, services and assets and what people are prepared to pay for those assets. If US asset demand falls, US assets will become cheaper in USD terms, all else equal, but that does not change the role of the US as the world's predominant supplier of those assets. I also cautioned against the overuse of economic coercion by the US government.

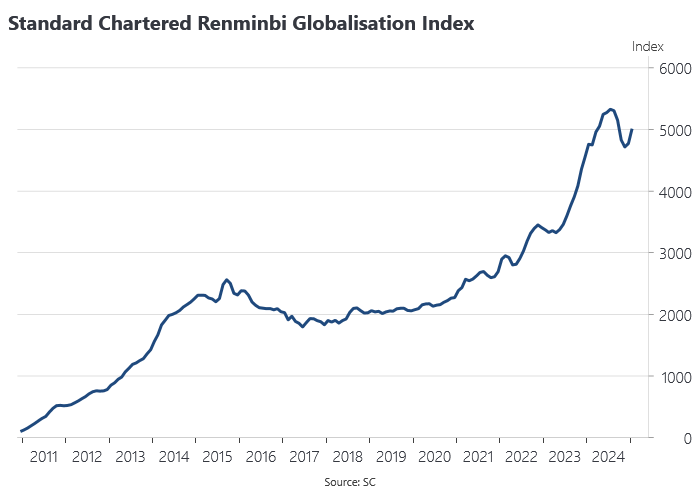

The Russian invasion of Ukraine and resulting US sanctions has given a boost to RMB internationalisation, as measured by the SWIFT data on international payments and trade finance and Standard Chartered's RMB internationalisation index:

The war has done more for RMB internationalisation than the Chinese government's own internationalisation campaign in the 2010s, which fell completely flat. It would not be surprising to see the world's pariah states continue to develop their own non-USD-denominated cross-border payments infrastructure. Even the EU has made some half-hearted efforts in this regard. But none of that changes the fundamental demand for US dollars to trade with or invest in the US.

Ultimately, the exchange rate, like money in general, is just a veil for underlying real factors. But it is still an important relative price. For all the havoc wrought by the second Trump administration, the USD may still come out on top.