The US April CPI occasioned much relief that the disinflation process has not completely stalled. The headline and various core measures all moderated at an annual rate. Most of this year’s inflation scare has been on the headline measure, which remains unchanged at an annual rate compared to December last year. Statistical core PCE inflation has still maintained a steady disinflationary path.

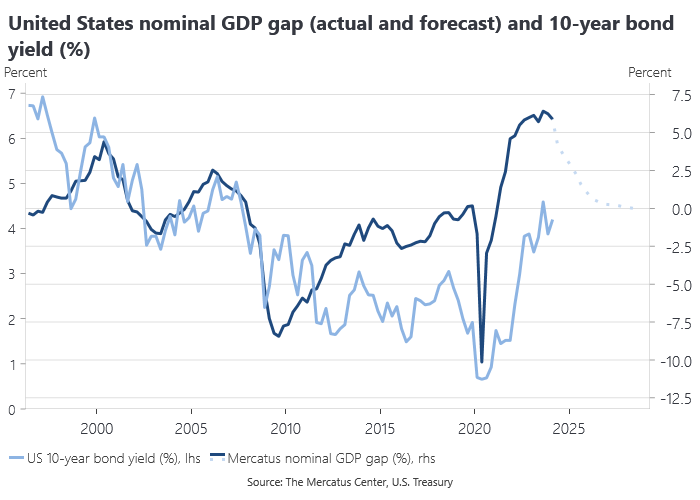

If inflation is proving more persistent than hoped, it is not unrelated to the persistent nominal GDP gap, which at 5.9% in Q1 is not significantly below the peak 6.1% gap seen in Q3 2023. The Mercatus measure reflects the difference between NGDP realisations and long-horizon expectations and is consistent with the US economy surprising broadly on the upside, with rising bond yields to match.

The Berger, Morely and Wong measure of the real output gap was 2.4% in Q1 and is actually nowcast to widen to 2.8% in Q2, implying an increase in excess demand pressures. This measure has narrowed from a record wide of 4.1% in Q2 2022, but putting aside the current cycle, you have to go back to Q1 1980 to find a larger positive output gap. That was followed by the Volker recession. The disinflation seen to date is impressive against this backdrop, but that momentum will be hard to maintain so long as the excess demand pressures suggested by these measures persist.