Lehman 15 years on: the ‘Lehman moment’ was not a Lehman moment

Plus, the US August CPI and Australia’s Q3 trimmed mean inflation rate

Friday marked the 15th anniversary of the failure of Lehman Brothers, an event that has become so synonymous with the financial crisis of that year that many have come to view it as the trigger for the crisis itself. This in turn has given currency to the view that if only Lehman had been saved, the crisis might have been avoided or substantially mitigated. But this conventional narrative is surely wrong.

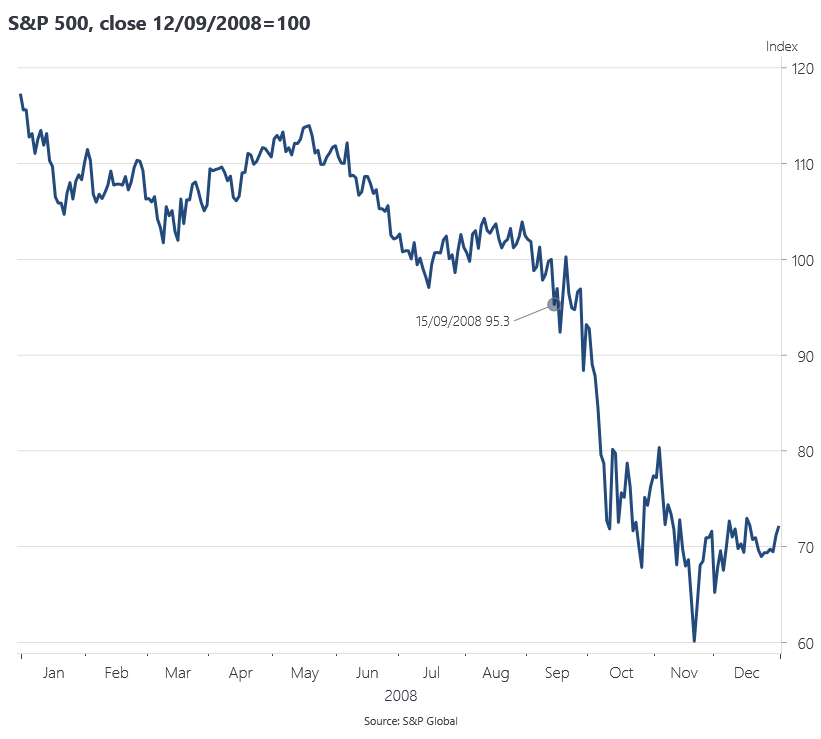

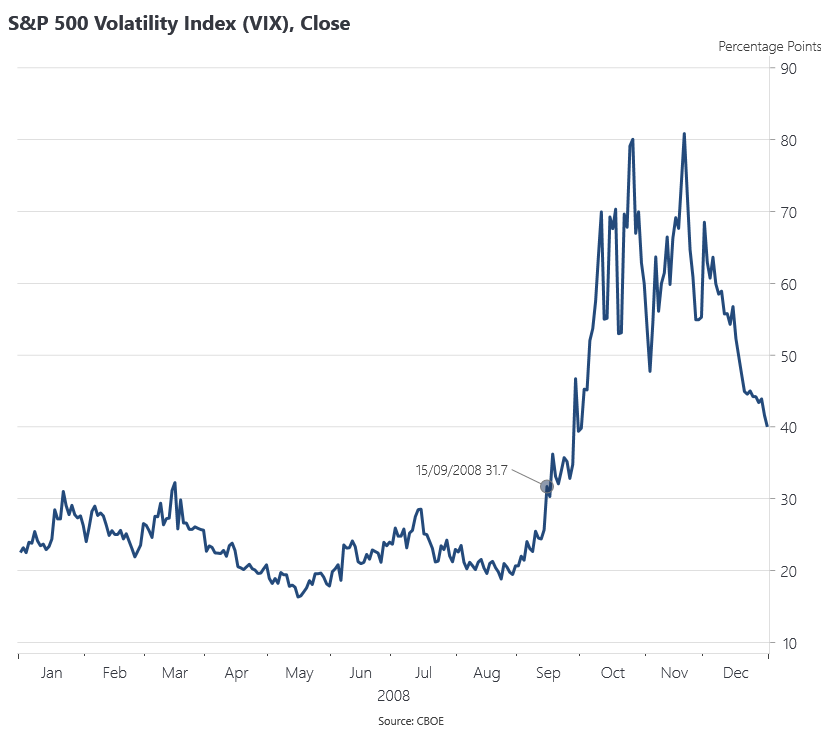

The initial financial market reaction to the Lehman failure was remarkably limited. Neither the S&P 500 stock index nor the implied volatility of that index suggest a major crisis on or immediately after 15 September. Indeed, the S&P 500 posted a higher close on 19 September than on either the 12th or 15th. The 16 September FOMC meeting notoriously left the Fed funds rate unchanged.

It was only after Federal Reserve Chair Ben Bernanke and US Treasury Secretary Hank Pauslon made speeches on 23 and 24 September predicting devastating consequences if Congress did not pass a proposed bail-out bill, and Congress then dutifully failed to pass the measure, that the stock market tanked. As John Cochrane later observed ‘the President gets on television and says the financial markets are near collapse. On what planet do markets not crash after that?’