Nice pro-cyclical asset you’ve got there. Shame if something were to happen to it.

Plus, whale watching

The record highs in the nominal gold price have naturally received a lot of attention, not to mention ex post rationalisation. One of our themes this year is that many supposed safe haven assets like gold and crypto have been trading pro-cyclically. That’s not necessarily a problem if you want to be long the cycle. But if your intention is to acquire assets that have a relatively high pay-off in bad states of the world, these safe havens may not work in the intended fashion. If your preferred safe havens are making record highs alongside equities, you might want to question their safe haven appeal.

Geopolitical risk is one factor cited in favour of the rally in gold and there is certainly plenty of that to go around. But gold would seem only loosely related to a leading measure of geopolitical risk based on newspaper stories. That might reflect a bias to reporting realised as opposed to potential geopolitical risks, but the recent relationship would seem even weaker than it has been historically.

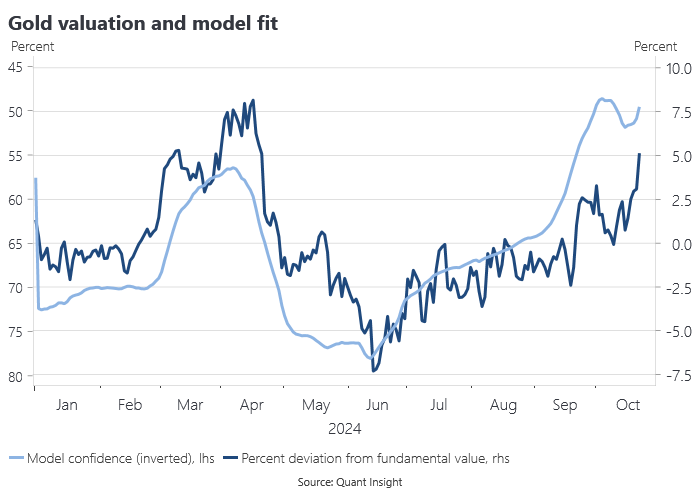

We can look at gold from the perspective of macro valuation models like those produced by Quant Insight. Gold is only five per cent over-valued based on their model and was under-valued by a similar percentage as recently as June.

Their model’s explanatory power moves inversely with deviation from fair value, such that over-valuation is associated with reduced model fit. That is consistent with a story in which over-valuation is driven by non-macro factors not captured by the model, of which geopolitical risk would be an obvious, but not the only candidate.

In the Barro-Misra model, gold’s return is equal to the risk-free rate given a lack of covariance with consumption (and by extension, GDP). The following chart based on the Quant Insight model shows the sensitivity of the gold price to a one standard deviation move in major economy GDP (based on GDP nowcasts) and constructed in such a way that the national GDP movements are independent of one another. The gold price is appropriately acyclical earlier this year, but more recently moves positively with GDP. This is consistent with gold being caught up in a pro-cyclical, risk-on moment associated with the prospect of a post-tightening cycle soft landing, reinforced by a Trump trade that is assumed to be good for US equities and the US dollar, but also inflationary and bad for bonds. Crypto also benefits from the Trump trade for policy reasons, but otherwise seems dominated by the cycle.