Orange Monday's Trump and dump yippy panicans and the springing of the Kindleberger trap

Plus, the RBA's 1991 policy shirk

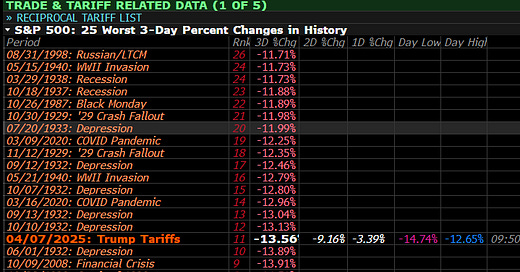

This week’s moves in global equity markets were right up there with the leading historical episodes of war, pestilence and depression, which is a pretty good guide to the likely effects of President Trump’s trade war with the rest of the world. Joe Weisenthal prepared a handy summary league table putting this week's moves in historical context:

While the 90-day stay on ‘reciprocal’ tariffs ex-China provided some temporary relief, the sell-off resumed later in the week. The notion that any trade deals will be done in the next 90 days should be heavily discounted. The US-China ‘phase one’ trade deal took 18 months to negotiate and changed very little. A fully-fledged trade agreement is usually the product of years, if not decades, of negotiations.

As global stocks sold off, the usual flight to safety bid in US Treasuries and the USD was replaced by a massive sell-off. US Treasury yields backed up by around 25 basis points in a matter of minutes and there was a major blowout in the spread to swap. Instead of the usual flight to quality and USD liquidity, we saw a run on the full faith and credit of the United States.

While deleveraging of the basis trade was likely a factor, many market participants agreed something much more profound was going on. US Treasuries no longer effectively hedge stocks and what we saw this week was likely nothing less than the death throes of US exceptionalism. US equities are underperforming their global peers and there is a very real prospect of foreign capital flight from the US.

It is worth recalling that foreign investors account for around 20% of US equities and 30% of Treasuries. ‘Weaponised trade’ will lead to ‘weaponised capital’ flows, making US Treasuries and the USD risky assets. As Charles Kindleberger argued, ‘For the world economy to be stabilised, there has to be a stabiliser.’ When the former global hegemon has nothing to offer but ‘yippy panicans,’ the Kindleberger trap is effectively sprung.

Disinflationary shock

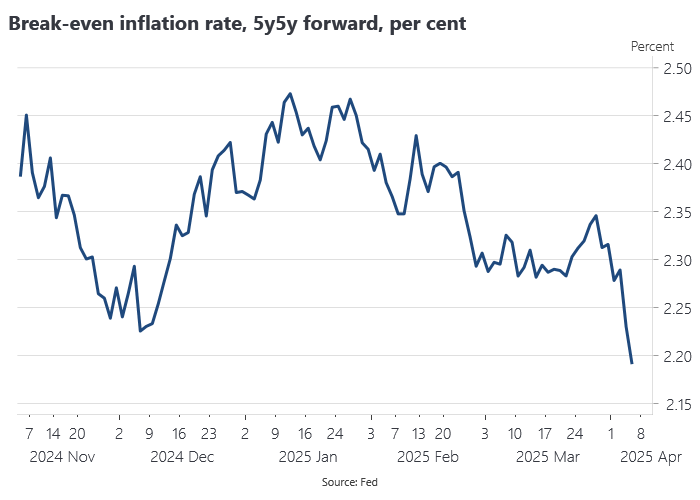

For all the talk of stagflation, the decline in 5y5y forward inflation expectations demonstrates that the tariffs are on net a disinflationary/deflationary shock for the global economy.

The hit to activity will be more significant than the price impacts because uncertainty will weigh most heavily on real activity once we get past the bring forward in trade ahead of the imposition of tariffs. Jason Furman had a good piece highlighting the damage inflicted by uncertainty and how the only way to restore US credibility would be for Congress to reclaim the tariff powers it has delegated to the President.

Full marks to Apple, who managed to airlift 600 tonnes of iPhones out of India before the tariffs hit. Supply chains will adapt and trade will divert but the tariffs are designed to impose an effective economic embargo on the United States and on US-China trade. Central banks should pick up the pace on easing policy, against the advice of the ever-present FT op-ed liquidationists.

Also noteworthy was the fact that China’s onshore RMB fell to its lowest level against the USD in 18 years as the authorities allowed for a lower fix for six consecutive sessions. A controlled and steady depreciation won’t offset the massive 145% US tariffs, but coupled with Fed easing, will help ease overall monetary conditions. A big one-off devaluation is also a perfectly viable option for China.

The rule of law and declinism as policy choice

The historic flight to safety bid in USD asset markets ultimately reflected the quality of US institutions and the rule of law. But as John Coates noted in an op-ed this week, the rule of law is under attack in the US like never before and this is bad for investment:

Law enables democracy and protects political freedom. But it is also critical to investment and finance. The benefits of a strong and independent judiciary and legal profession are clear. They include protection of property rights, enforcement of contracts, and more vigorous market competition. Without reliable law and an ability for private businesses to defend their rights, investment shrivels. While details of reliable legal systems vary, sine qua nons include prior notice about what the law is, independent judges, and autonomous lawyers who can advise and advocate for the public.

Back in 2009, the late great Charles Krauthammer said:

The question of whether America is in decline cannot be answered ‘yes’ or ‘no.’ There is no ‘yes’ or ‘no.’ Both answers are wrong, because the assumption that somehow there exists some predetermined inevitable trajectory, the result of uncontrollable external forces, is wrong. Nothing is inevitable. Nothing is written. For America today, decline is not a condition. Decline is a choice.

With global markets now actively shorting American exceptionalism, it is clear that the US has chosen very poorly indeed.