Scott Bessent’s ‘economic lollapalooza’

Plus, Bessent on Abenomics; and Australia’s exposure to the United States is 2x China

Ben Stein (son of President Nixon’s CEA Chair Herb Stein) teaches the kids about tariffs in Ferris Bueller's Day Off (1986).

The second Trump administration is taking shape, with Kevin Hassett back heading NEC and Robert Lighthizer’s former chief of staff Jamieson Greer as USTR. Greer told Congress earlier this year that the US should revoke permanent normal trade relations with China. Trump’s nomination of Scott Bessent as Treasury Secretary last weekend had a calming effect on financial markets and weighed on the US dollar for a few days until the President-elect blew-up the Trump trade yet again with his tariff announcement.

Bessent’s appointment will please those looking to normalise or rationalise the new administration. One German think tank commentator sought to compare Bessent to James Baker, somewhat overlooking the fact that Trump is no Ronald Reagan. But it would be unwise to hang your hat on Bessent’s or anyone else’s ability to discipline Trump.

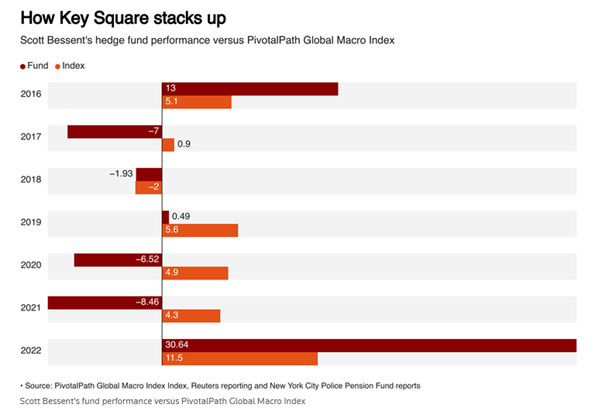

Bessent is a former hedge fund manager and presided over one of the biggest ever launches of a macro hedge fund that has since seen a dramatic decline in funds under management. Returns to the fund are shown below and have been characterised as averaging mid-single digits since launch in late 2015.

Source: Reuters.

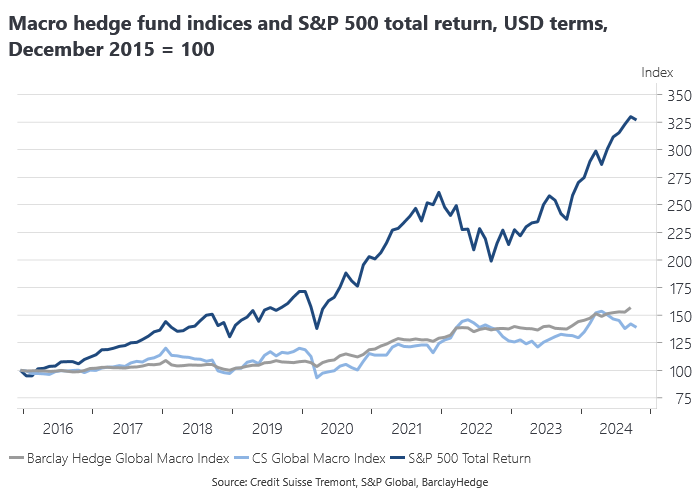

Bessent had a good 2022 betting that inflation would prove more persistent than most expected and the fund’s returns in 2023 and 2024 are also meant to be good. The volatile returns are typical of macro hedge funds. Macro is a tough business, as suggested by the following chart comparing the two leading macro hedge funds indices and the S&P 500 over the period since Bessent’s Key Square fund launched.

The good news is that your low fee Vanguard S&P 500 index fund outperformed the average macro hedge fund. Australia’s Future Fund was one Key Square investor, although appears to have pulled that mandate subsequently.

It is fair to say that Bessent knows something about how markets will react to policy shocks, but that does not mean that his advice to Trump will be listened to. Bessent has proposed something akin to Abe’s Three Arrows for the US built around a three per cent economic growth target, a three per cent of GDP budget deficit by the end of Trump’s term in 2029 and three million barrels (I assume bpd) of equivalent of additional energy production. These are worthy goals, although also sound rather like China’s State Council growth targets. It is one thing to have targets, quite another to have policy frameworks in place and the discipline in decision-making that will deliver on those targets.

Interestingly enough, we have the benefit of Bessent’s own speculations and commentary on the economic implications of a Trump Presidency via his letters to Key Square fund clients. I have only come across one of these (readers feel free to send in more examples). In the letter from January this year, Bessent correctly identifies the Trump trade as a positive for stocks and recommends going long equities as Trump’s prospects improve, citing the usual factors including tax cuts, deregulation, energy independence and ‘reviving US manufacturing.’