The Big Aussie Short at the cash rate cycle peak: not so big

Plus, the next RBA Governor is...; and Ian Macfarlane and Bill Evans on the RBA review

The RBA’s decision to raise its official cash rate by 25 basis points this week was best characterised by Zac Gross, who called it ‘inconsistent, unexplained and ultimately ... correct.’ Had the RBA raised the cash rate in April and then paused in May, as I had expected prior to the April meeting, their actions would have made perfect sense. The timing makes little difference economically, but from a presentational perspective, the pause in April is inexplicable, particularly given the strong case for further tightening contained in the April Board minutes. As things stand, the IB futures strip is giving little chance to further tightening ahead of a new easing cycle in 2024.

The implied peak in the cash rate cycle broadly coincides with the fourth consecutive monthly increase in capital city dwelling prices, consistent with a trough in house prices at the end of 2022. This means we can probably draw a line under the latest iteration of the Big Aussie Short (the investment thesis that argues for shorting AUD markets to capitalise on large declines in house prices and their macroeconomic implications).

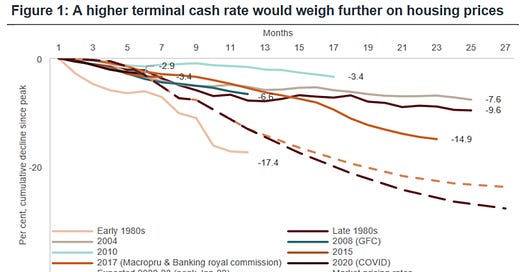

In September last year, we queried some of the predictions for big falls in house prices then being made conditional on expectations for higher interest rates, noting the resilience seen in the face of previous cash rate tightening cycles. Admittedly, the cash rate has seemingly topped out a little below earlier projections, but the predicted 20+% declines in house prices have not eventuated. Last time, we reproduced this chart from Barrenjoey Capital as being representative of the broader genre: