The Fed declares victory

But the RBA remains wedged in the ‘narrow path’

Meme via Joey Politano.

The Fed’s new easing cycle got off to a flying start this week with an outsized 50 basis point cut to the Fed funds rate target, consistent with pre-meeting media stories in the WSJ and FT. Given that many thought the steady policy stance at the July FOMC meeting was a mistake, a catch-up move at this week’s meeting is less surprising.

The start of a new easing cycle is effectively a declaration of victory over inflation, although also recognition of incipient signs of weakness in the US economy. Yet the US economy continues to perform well in both absolute and relative terms. This in turn points to a highly credible monetary policy regime that was able to disinflate without having to sacrifice too much in terms of growth or employment. The consensus view that saw a recession in 2023 as an inevitability was predicated on the mistaken notion that a substantial disinflation could only be achieved through recession rather than a credible monetary policy strategy.

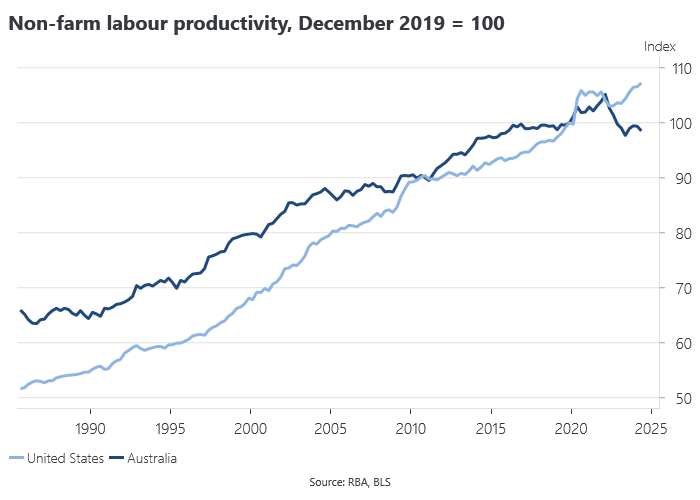

An important element of the post-pandemic recovery has been a surge in US productivity growth, which has seen the level of labour productivity exceed its pre-pandemic level, in contrast to many other economies, including Australia.

As Joey Politano has pointed out, the post-pandemic trend rate of productivity growth in the US also slightly exceeds its pre-pandemic trend rate. This is largely attributable to high levels of output in capital-intensive sectors such as tech and oil and gas, which have seen big increases in output relative to hours worked. The US economy is working to its strength, even against a less than supportive backdrop from public policy.

US outperformance

US outperformance is particularly noticeable when comparing the post-pandemic evolution of real GDP per capita to that seen in the rest of the dollar bloc.