The inflation effects of quantitative easing: getting over QE aversion

Plus, RBA comms in 2024

As former Governor Lowe headed for the exit towards the end of last year, we noted his throwaway line to an ABE lunch that the RBA’s pandemic bond purchase and yield targeting had been ‘helpful but not particularly effective.’ This was an extraordinary claim, not least in begging the question as to why the RBA now has an inflation problem. Similarly, in November, Governor Bullock told an ABE dinner the effect of QT was ‘pretty marginal.’ That is hard to square with investor scrutiny of the Fed’s intentions with respect to its QT program.

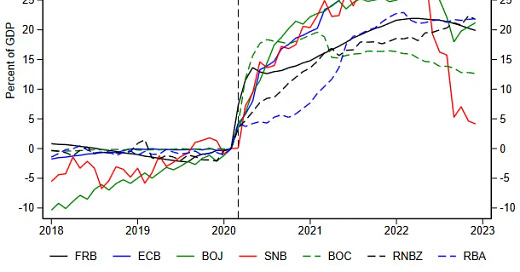

Lowe and Bullock’s claims are not necessarily inconsistent with the evidence from Australia to date, with only one episode of QE under our belt, but it is not what has been found offshore. In a new-ish paper for the CEPR (known in the early 2000s as the Center for Eating at Posh Restaurants) T. Rowe Price Chief European Economist Tomasz Wieladek finds ‘the inflation effects of QE are two to four times larger than those of conventional monetary policy in the UK and the US.’