The macro mob called

It wants its intelligentsia back

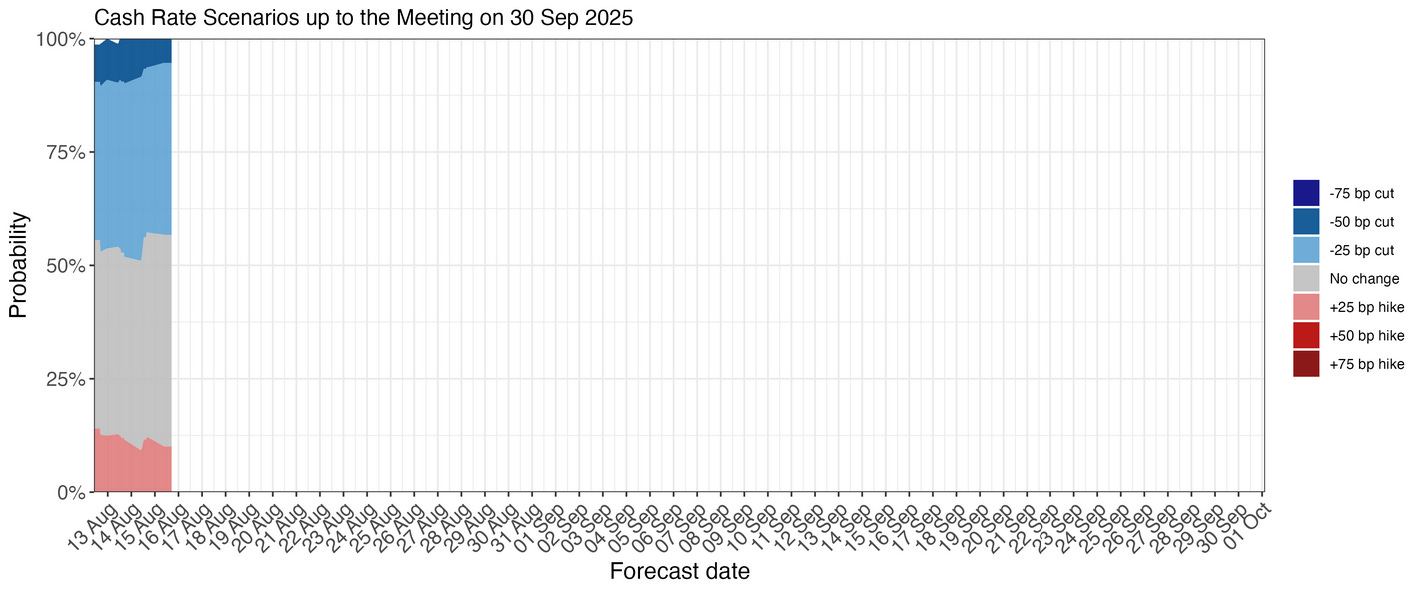

The US July headline CPI came at 2.7% y/y, which was sufficiently tame to have markets expecting an 85% chance of an easing in US monetary policy when the FOMC next meets in September. Jason Furman's ecumenical measure of underlying inflation is running at about 2.6%, which is close to target on a PCE basis. The Cleveland Fed's trimmed mean inflation rate points to another 0.6% q/q print for its Australian counterpart in Q3, based on our highly parsimonious model relating the two. That has local cash rate futures implying a 38% chance of a 25 basis point easing at the RBA's meeting in September, based on Zac Gross's estimates.