The RBA review panel’s half-time report

Plus, giving Twitter the bird; and exit, voice and loyalty in retail super

Photo credit: AFR. L-R Dr Gordon de Brouwer, Carolyn Wilkins and Renée Fry-McKibbin, with moderator Melinda Cilento.

The RBA review panel fronted a CEDA event this week, providing the first formal public feedback on the review process. The review also released a media statement summarising progress to date. The focus of the CEDA event was on what the panel has heard through the consultation process rather than indicating where the review might land on various issues, although there were also some important hints on where the review is going.

The panel said that the submissions to the review will be made public in the next two weeks. There is also commissioned work from international experts currently underway. Given we are now half-way through the review process, it would seem unlikely we will hear much more from the review in public before it reports to the government in March next year.

A key theme to emerge from the panel discussion was the importance of RBA communications and its role in promoting accountability. As we discussed in last week’s newsletter, this has been a key shortcoming in the RBA’s conduct of monetary policy and it is no surprise that it is front and centre for the review. The comms issues are closely related to the issue of poorly formulated monetary policy strategy.

On governance, the panel indicated that consideration was being given to the role of the Board and whether monetary policy decision-making should be split off from governance and other operational responsibilities. Feedback to the panel said that there was a high bar to be cleared before opening up the RBA Act to change. The panel said they were considering putting to government two sets of reforms options, one of which would entail changes to the Act and another set that would not require legislative change. Wilkins indicated that if they thought that opening up the Act was the best option, they would make a recommendation accordingly, ‘but we are not there yet.’ The problem for the review panel is that the role and composition of the Board is defined in the Act and it is hard to imagine the review could credibly settle on the status quo on either of those two issues.

Gordon de Brouwer said that there was a lot of ‘generosity’ in relation to the RBA’s pandemic response, given the unprecedented nature of the shock and also the use of new (for the RBA) operating instruments. But I think that understates how much was already known based on experience overseas in responding to previous shocks. The RBA dragged the chain on its initial response to the pandemic because it had not fully internalised these previous lessons, summarised in my paper for USSC in 2019. In late 2019, a former senior public servant (not Gordon) told me the RBA already knew everything in that paper. As I said then, knowing something and acting on it are two different things.

Renee Fry-McKibbin indicated the review was looking at different targeting frameworks and explicitly nominated nominal GDP and price level targeting, among others. I suspect the internationally commissioned work is focused on a policy rule horse race similar to that conducted by the Bank of Canada. On the RBA’s internal culture, Gordon de Brouwer noted that ‘it's not as open, it's not as contestable, in terms of its internal debate as it could be.’ Carolyn Wilkins was particularly complimentary on the scope and the intent of the review and suggested the review could potentially become a model for other countries.

Overall, the discussion at the CEDA panel suggests the review is asking all the right questions and will make a good set of recommendations. It will then be incumbent upon the government to act upon them. My expectation is that sometime between March 2023 and September 2023, the government releases their report, agrees to many of the key recommendations and announces a new governor to implement them in a big bang monetary reform package.

Perhaps the biggest uncertainty is how the review will come to evaluate the leaning against the wind episode from 2016-19 and the initial pandemic response from March to November 2020. The gist of the comments on both those episodes from the review panel was that they were hearing different things and balancing competing narratives. My 78-page confidential submission focused mainly on those two episodes, not least because they indirectly highlight many of the other issues around governance, transparency and accountability, making a good case for reform. Hopefully, the review panel comes to see it the same way.

Note Governor Lowe will appear before Senate estimates on Monday 28 November at 10am AEDT.

Giving Twitter the bird

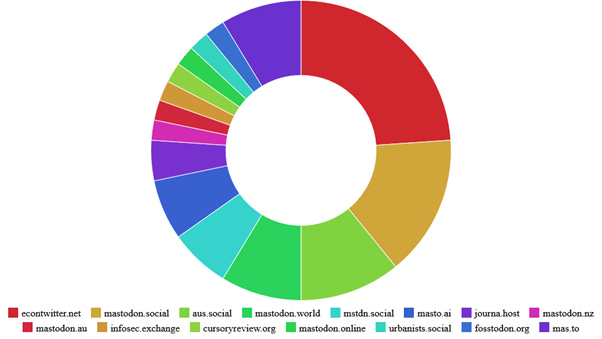

I am now on the econtwitter.net instance at Mastodon (click the link to follow). My first follower there was Michael Clemens, so it’s a high-quality space! Mastodon strongly appeals to my federalist instincts. My experience of Twitter has been mostly positive, but while it has been privately beneficial, I think the world would be better served if a multi-jurisdictional, distributed order competed with, if not supplanted, it. That argument is quite independent of anything Elon Musk might do to the bird site, but he certainly helps illustrate the point.

Twitter has always struggled to make money and it would seem unlikely Musk will solve that problem. Mastodon, by contrast, has more robust, distributed funding that is not as exposed to commercial imperatives. With no controlling entity, it is also less vulnerable to regulatory and political attack.

I am not the first person to observe that Twitter is not very effective in promoting engagement with other content. During my time in think-tanks, I found Twitter close to useless for promoting my work. Most organisations are over-invested in Twitter. It drives too little traffic or other engagement to be worth much time or effort, unless a Twitter presence is an end in itself. I suspect for many organisations, a Twitter presence is mainly defensive, but increasingly, the best defensive use of Twitter might be to get off it. For mine, it’s main value is as a self-curated newsfeed, but my old-timey RSS feed contains more useful content.

Here is a handy intro to Mastodon. Debirdify will help you locate your existing follows/followers. Here is a pie chart showing the distribution of my Twitter followers by instance, which might be useful if you are looking for a home:

I use the Metatext app on iPhone to read the toots.

Also, a reminder that the person managing a particular instance can read your DMs. So don’t DM me there. Not that your Twitter DMs were ever particularly safe.

Exit, voice and loyalty in retail super

My rollover to Vanguard’s new retail super product is largely complete. The process was very straightforward. Vanguard processed their end of the rollover request in less than 24 hours.

I had to supply Vanguard with the member number at my existing fund. When the fund acquired Vanguard’s then retail super clients more than 10 years ago, it retained the existing Vanguard member numbers for its newly acquired customers. So, Vanguard, if that number rings a bell, it’s because it’s the same one you assigned me more than 20 years ago in your first venture into retail super. We really have come full circle. Here’s hoping the second go around the block works out better for all concerned.

As many people have pointed out, there are some cheaper indexed offerings in the market than Vanguard’s. For mine, fees and other product attributes are major, but not the only considerations in choosing a fund. What they do with the fees matters too. Your choice of fund has implications for what the super industry looks like.

My previous fund rolled up its passive bond offerings into an active fund that charged higher fees. I read enough bad macro takes from bond managers in the AFR to know I don’t want active management of my bond portfolio (unless I’m the one doing it).

Once again, not investment advice!

ICYMI

Special Issue of Economic Analysis and Policy in honour of the late Professor Tony Makin. See also my obituary for Tony in The Economic Record.

Housing Breaks People’s Brains: Supply skepticism and shortage denialism are pushing against the actual solution to the housing crisis - building enough homes.

If only the opposition leaders were running the Bank of Canada. If only they could agree how.

This otherwise good article mentions the "blockbuster" Hsieh & Moretti results on the welfare costs of restrictions on housing supply. In fact, the costs are much larger than the original estimates cited in the article. See Bryan Caplan's post on the original misreporting of these estimates, which makes the paper even more blockbuster than the authors realised.

Inflation Targeting Doesn't Exist:

Memes and themes: