The RBA building at 65 Martin Place under construction circa 1962.

This week we learned that the RBA’s headquarters at 65 Martin Place is so riddled with asbestos it will have to be stripped back to its steel frame as part of an ongoing renovation now expected to cost $850 million. The overhaul of the building is symbolic of the way in which the framework for Australian monetary policy has been remodelled following the recommendations of the RBA Review, removing some of the mid-century hazardous material from the RBA’s statute and operating procedures.

The new format for RBA Board meetings got its first outing this week. The Board met to deliberate on Monday before reconvening again on Tuesday to make a decision, giving it more time to be briefed and discuss policy. The February Statement on Monetary Policy was released at the same time as the monetary policy decision instead of the former Friday release, eliminating the awkward gap in which the monetary policy announcement would anticipate, but not fully disclose, the new forecasts that informed the Board’s deliberations. The new lower frequency Board meeting calendar is now better synced with the ABS economic release calendar.

The new Statement on Monetary Policy

The Statement has a new format, including explicit forecasts for variables that were previously only implicit. Most notably, the Statement now includes an explicit official cash rate assumption based on market forecasts. The February Statement also included a discussion of full employment, elaborating on how the Board thinks about this part of its mandate. The changes in the RBA’s forecasts relative to November last year are helpfully illustrated in the following chart due to

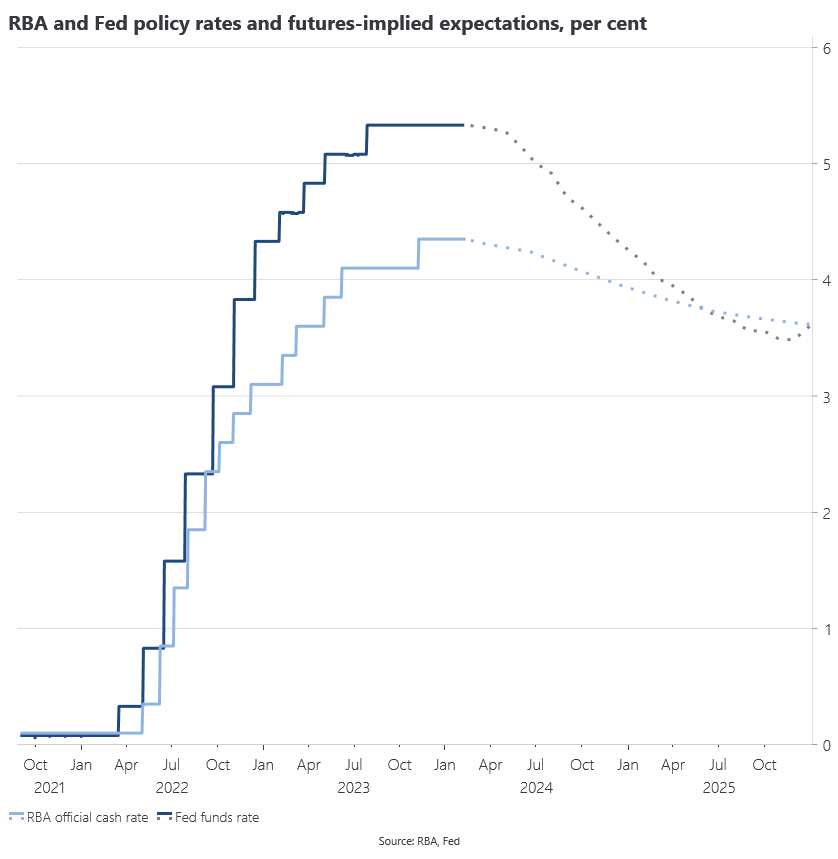

’s R code:Current market pricing in the wake of the Statement has the RBA’s official cash rate and the US Fed funds rate converging around May 2025, with the RBA lagging the Fed in the magnitude of its prospective easing cycle.