Meme credit: @yusufimaadkhan.com

On 15 August 1971, President Nixon announced a 10% import surcharge, a 90-day freeze on prices and wages, and the closing of the gold window in what became known as the ‘Nixon shock.’ The import levy was only in place for 127 days before the Smithsonian agreement delivered an upward revaluation of major trading partner currencies against the USD and a devaluation of the dollar in terms of gold.

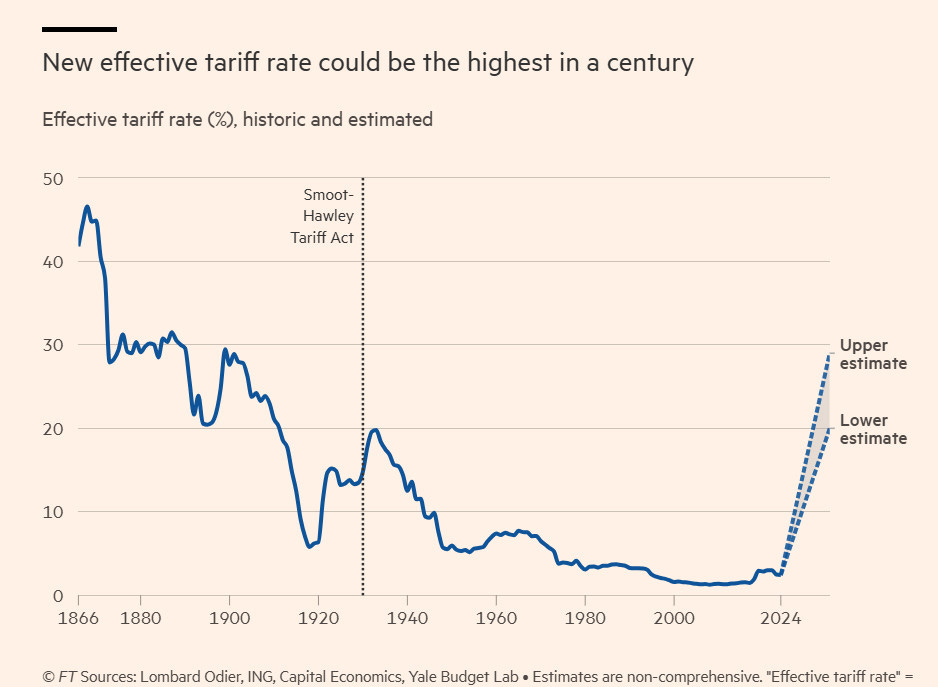

This week’s tariff announcement by President Trump does not deserve to be called a ‘shock’ because, before last year’s election, he said he would impose a 10% across-the-board tariff and 60% tariffs on China. As things now stand, China is subject to a 54% tariff and the rest of the world has a 10% baseline tariff that scales with any trade surplus they have with the US. Depending on how you count it, the average US tariff rate is at least equal to the Smoot-Hawley tariffs of the 1930s that deepened the Great Depression. 1930s-style tariff policy is likely to lead to 1930s macro outcomes and the odds of a US recession on prediction markets have surged to better than even.

It didn't take long for analysts to realise that the formula for the increased tariff rate over the baseline 10% was half the goods trade deficit with a trading partner divided by their exports, for a maximum additional tariff rate of 50%. This was applied in blanket fashion to most countries and even to some non-countries with no meaningful trade with the US. The formula absurdly assumes balanced trade as the norm, although is asymmetric in that a trade deficit with the US still gets you the 10% baseline tariff.

From a legal standpoint, the formula is not quite as arbitrary as it might seem. As Mona Paulsen and Dan Ciuriak point out, 50% is the legal limit of Section 338 of the Tariff Act of 1930, a never-before-used instrument that authorises the President to impose tariffs of up to 50% in a wide range of circumstances. While this week’s Executive Order did not explicitly invoke s338, it would seem that the administration is seeking to put in place a tariff regime that is as legally robust as possible. That in turn suggests the tariffs are meant to be permanent. Paulsen and Ciuriak also have some helpful suggestions as to how small open economies should organise to respond to the tariffs.

Legal technicalities aside, Alan Beattie is surely correcting in arguing:

There can be no logic-washing of Donald Trump’s tariffs. This isn’t part of a carefully-designed industrial policy or a cunning strategy to induce compliance among trading partners or a choreographed appearance of chaos to scare other governments into obedience. It’s wildly destructive stupidity, and the generations of American, and particularly Republican politicians, who allowed things to slide to this point are collectively to blame.