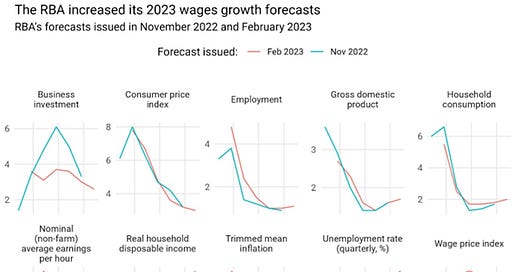

The US January CPI and the Australian inflation and wages outlook: pushing out the peak in the inflation process?

Plus, landing the RBA review

The US January CPI came in as expected at 0.5% m/m and 6.4% y/y, although this represents an acceleration on the monthly pace seen in November and December last year.

The Cleveland Fed’s trimmed mean …