US dollar assets continued to underperform this week. The longer this goes on, the less the market response to the trade war looks like a one-off deleveraging/liquidity event and the more it looks like a run on the full faith and credit of the United States. Both the US dollar and Treasuries have sold off, which is hard to reconcile as anything other than a generalised run on the United States. Steve Kamin puts the underperformance of the USD relative to fundamentals at around 10%.

US equities are down around 8% since election day, compared to a 3% gain for equities in the rest of the world. Remarkably, US equities are even underperforming emerging market stocks. This is what global equities look like since the peak in US stocks in mid-February.

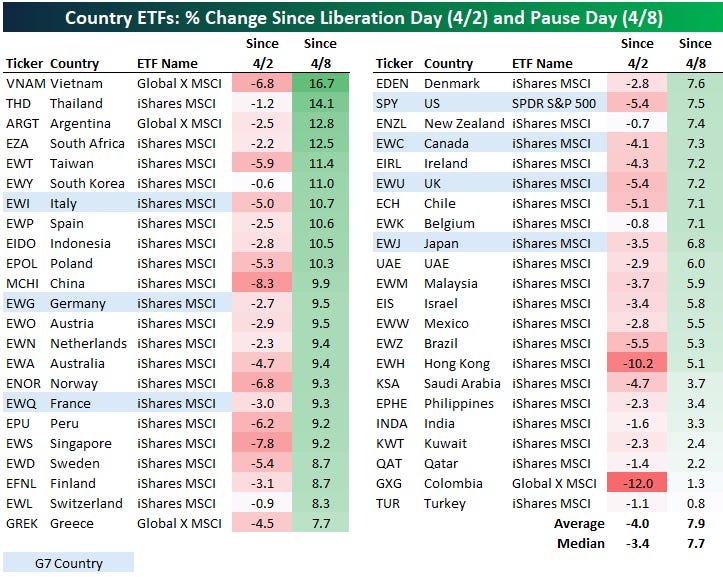

Bespoke Investment Partners did a run-through of the country ETFs as a gauge of who gets hardest hit by tariffs, at least from a market perspective. It’s notable that the US suffered more than the mean/median.

Treasuries are the only part of the pre-election Trump trade of higher equities/USD/Treasury yields that remains notionally in tact, but for the wrong reasons. Treasury yields were meant to rise due to stronger economic growth, but expected growth has collapsed and yields have risen anyway.

The BoA global fund manager survey for April was appropriately dire, with US equity intentions at a record underweight.

Allocations to cash saw the largest two-month increase since April 2020. 82% of respondents expect the global economy to weaken, 42% expect a US recession. 61% expect the dollar to depreciate over the next 12 months, the most since May 2006. You might argue that this is looking like a crowded trade, with even The Economist magazine cover chiming in, but given what is in the prospective tariff pipeline and the poor prospects for any trade deals, it is too early to go full contrarian.