Yet another TACO Tuesday

Plus, grading the year ahead consensus; and the new RBA Statement on the Conduct of Monetary Policy

It was yet another TACO Tuesday this week, as President Trump kicked the can down the road on his 'reciprocal' tariff regime until August 1, while upping the pressure on trading partners via new tariff rate announcements. The shifting deadlines speak to the failure of the administration's tariffs-first trade strategy. This will only exacerbate the uncertainty regarding where the US tariff regime will ultimately settle, if at all.

Trump announced a new 50% tariff on copper imports, while proposing a 10% tariff on countries aligning themselves with the BRICs group of countries and a 50% tariff rate on Brazil. The Brazil tariff broke new ground in being linked to Brazil's domestic politics rather than trade per se. In announcing a 35% tariff rate on imports from Canada. Trump said:

We’re just going to say all of the remaining countries are going to pay, whether it’s 20 per cent or 15 per cent. We’ll work that out now.

The deferral to August 1 will string along the TACO trade and the market's conviction that deals will ultimately be struck where they haven't already. Markets want to believe this will all be resolved. The tariff rates might come in lower than threatened, but they will still be much higher than before, and the intervening uncertainty will weigh heavily. US earnings forecasts have already fallen substantially this year, even if they remain historically elevated. If the August 1 deadline gets kicked for another 90 days, we will be coming up on year-end with no resolution.

Grading the year-ahead outlooks

At the beginning of the year, I fed nine investment bank year ahead outlooks into ChatGPT to distill a consensus outlook for the global economy and markets. The results can be found here. Halfway through the year, it is worth marking the consensus to market as a level set on H2.

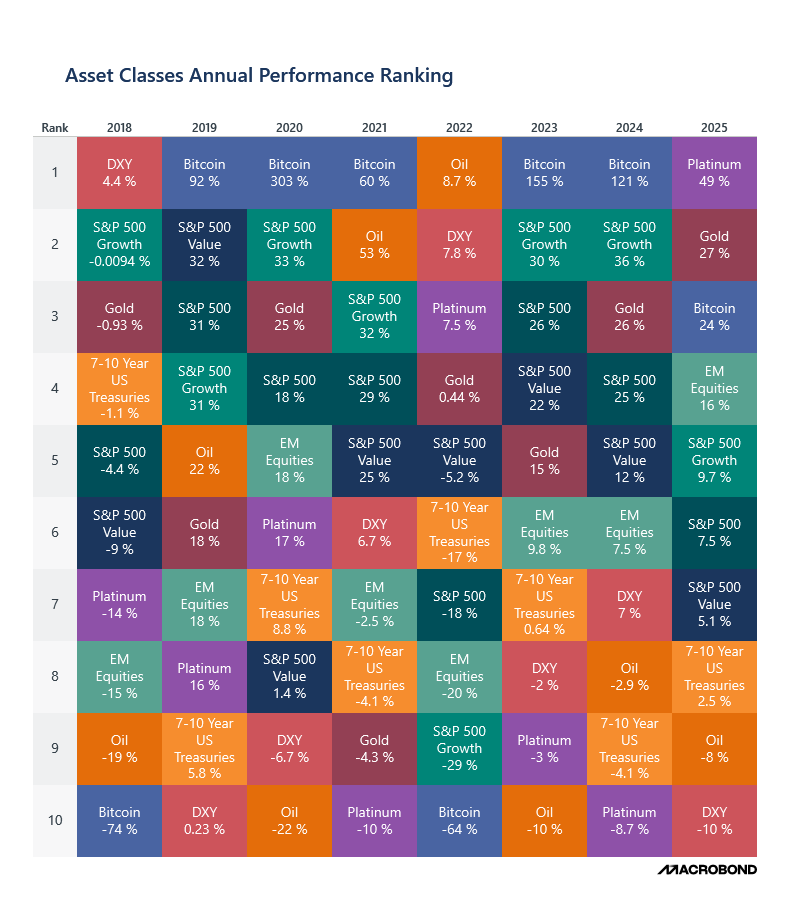

First, a quick review of selected annual asset returns. 2025 is the change from a year ago:

The turn of the year outlooks captured the main risks, although they underpriced both the likelihood and magnitude of the tariff shock. This is hard to excuse, given that Trump had been very explicit about his intentions. While trade policy turned out worse than expected, accounting for the market ructions in April, markets have, for the most part, given Trump the benefit of the doubt.

The year ahead outlooks were mostly positive on the USD, which was expected to do well, but especially if geopolitical risks came to the fore. Given that most of the outlooks anticipated easier US monetary policy than actually materialised, USD underperformance would have to be the big surprise of 2025. This is consistent with the outperformance of EM equities, which benefit from USD weakness even in the absence of a change in the notional stance of US monetary policy. USD weakness also flatters the returns to USD-denominated commodity prices.

US equities and the US dollar are typically negatively correlated, and many investors rely on USD exposure to offset equity market risk. That hasn't worked in 2025 and has seen a scramble to hedge USD exposures and up the hedging ratios on holdings of US equities. US dollar weakness will otherwise add to the underperformance of US equities in local currency terms. So while US asset markets have done well in an absolute sense, they have done poorly in a relative sense, which is consistent with the US being the main victim of Trump's tariff policy. If you underweighted the US based on trade policy risks, you have probably done well on a relative basis.

Global growth has been downgraded to 2.8% in 2025 by the IMF, reflecting the trade policy shock, compared to a turn-of-the-year consensus of 3.1%. Both the Eurozone and China have exceeded expectations, at least as of Q1. I think it is fair to say that Europe and China have been positively re-rated on a relative, if not absolute basis, since the beginning of the year. India is also doing better than expected, with growth around 6.8%-7% based on Q2 data.

US rate cuts have proven more elusive than expected, with the Fed funds rate unchanged at 4.5% this year and the bar to further reductions seen as higher, although not insurmountable. This helps explain the more challenging environment for fixed income this year than the consensus anticipated. The benign outlook for monetary policy and fixed income was one of the potential points of failure for the consensus we highlighted at the turn of the year. Together with the ambiguous implications of the tariff shock for fixed income pricing (higher inflation/weaker growth), bonds have done worse than expected, although their hedging role seems mostly intact.

While the Middle East was identified as a broad geopolitical risk in the year ahead consensus, Iran was not specifically mentioned in any of the outlooks. Oil and gold were both recommended as exposures to hedge geopolitical risk. The gold hedge worked, although in the context of a pre-existing uptrend, but the oil hedge didn't in exactly the scenario in which it might have been expected to come good.

Markets have also given Trump a free pass for personal attacks on Jerome Powell that would have induced an exchange rate crisis in many other jurisdictions. It is worth recalling that Jay Powell and Fed independence are the thin red line between a regime of monetary and fiscal dominance. Developments in Fed governance should be closely watched. A regime shift would completely upend most of the assumptions and correlations underpinning capital market dynamics.

In this context, it is worth noting that Aswath Damodaran has just added a non-zero country risk premium of 0.41% to the US for the first time in 30 years following the Moody’s downgrade.

Obviously, the US CRP doesn't rise just because Aswath puts one in his dataset, although his data is widely used and referenced. We noted last year that estimates of the shadow US CRP have been rising since the first Trump administration, which should make us cautious about US asset market exposures. I discuss the US country risk premium here.