Michele Bullock speaks to the Anika Foundation lunch in Sydney this week. Photo credit: Stephen Kirchner.

The minutes of the RBA's July Monetary Policy Board meeting shed a bit more light on its decision to leave the official cash rate unchanged in a six-three decision, with the minority supporting a lower cash rate. Presumably, the dissenters wanted the cash rate lowered by 25 basis points instead. But strictly speaking, we don't know that from the minutes. While it is good to know the breadth of support for the current or proposed stance of monetary policy, it would also be useful to know something about its depth. If one MPB member were pounding the table for a 100 basis points easing, should we expect to see that reflected in the minutes?

We know from rational choice theory that the order of voting on a committee can matter to the outcome. The minutes seem to suggest the MPB was given two options by the chair and voted accordingly, but there may be situations in which the Board has to weigh and vote on a more complex set of alternatives. The order of deliberation and voting should be legible from the minutes.

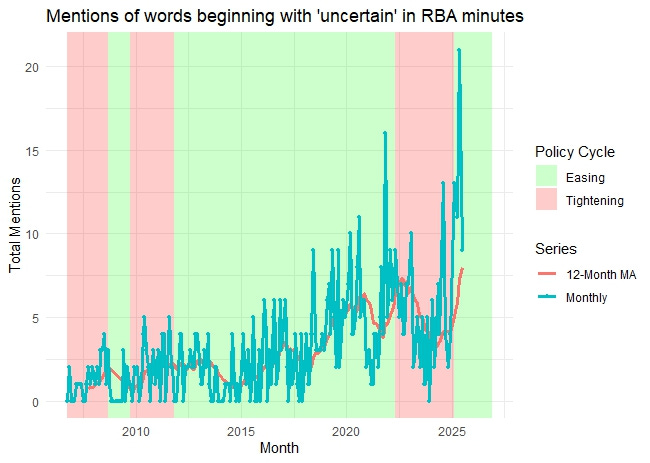

References to variants of 'uncertainty' declined from the May meeting's record high count, which no doubt played into the steady outcome for the cash rate (thanks to Matt Cowgill's R package).

When virtue is its own reward

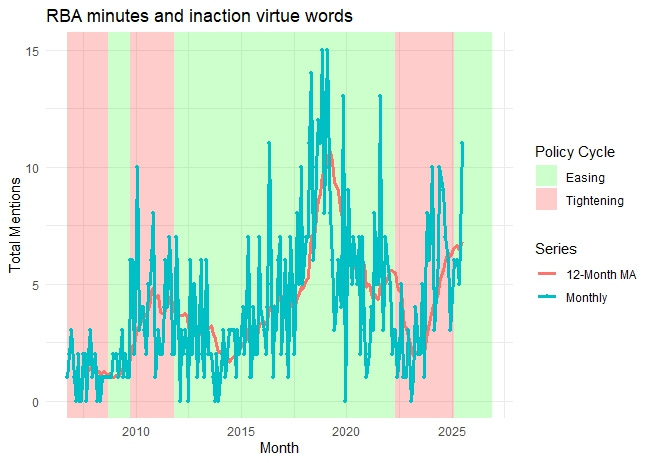

In place of 'uncertainty,' we saw a return of the inaction virtue words the RBA typically leans on when it wants to rationalise leaving policy unchanged. The words 'cautious,' 'gradual' and 'prudent' all put in an appearance in the course of three consecutive sentences. The full count is shown below. The count doesn't include 'prudent', but we might add this to the thesaurus of inaction if it continues to make an appearance in the minutes.

The context for the inaction virtue words was that the MPB:

believed that lowering the cash rate a third time within the space of four meetings would be unlikely to be consistent with the strategy of easing monetary policy in a cautious and gradual manner to achieve the board’s inflation and full employment objectives.

This is just a little too close to the now notorious 'confidence and stability' formulation the RBA sometimes used to justify inaction, even as inflation ran systematically below target. Caution and gradualism have their place in a monetary policy strategy. Interest rate smoothing is well-established feature of monetary policy, but the RBA's smoothing parameter has been characterised as 'deep stasis' and there is a risk in making a virtue out of inaction. I have previously written about how the former RBA Board entertained spurious ideas about perverse signaling effects from greater monetary policy activism.

The minutes debate the question of whether or not monetary policy is restrictive based on assumptions about the neutral level for the cash rate. Governor Bullock told this week's Anika Foundation lunch that the RBA was re-examining its productivity growth assumptions in an effort to gauge whether weak demand growth was actually attributable to weak supply, to which demand growth presumably needs to be accommodated.

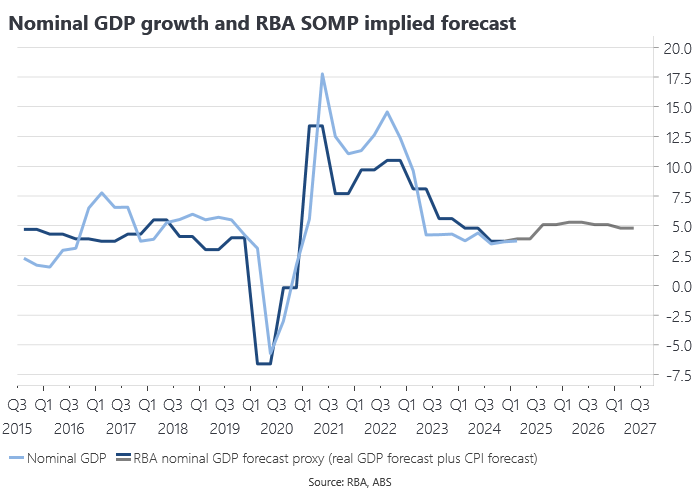

Nominal GDP growth is a sufficient statistic in this regard and is running below the RBA's implied assumptions for medium-term nominal GDP growth of around 5% if we allow its CPI inflation forecasts to stand in for the overall GDP deflator (the long-run growth rates are identical and consistent with the inflation target).

Q2 nominal GDP growth should come in around 4.2% y/y based on the ABS business turnover series (Xero has unfortunately stopped publishing their annual sales growth series, which was a useful nowcast for nominal GDP growth). That tells us that policy is restrictive, without having to take a strong view on either the neutral rate or productivity growth.

The monthly CPI: better late than never

We got confirmation this week that Australia will release a full monthly CPI from 26 November, although the existing quarterly series will continue to run for at least another 18 months. I made the case for a monthly CPI way back in 2010.

Apart from the obvious benefits to monetary policy decision-making, a monthly CPI should also increase foreign participation in Australia's index-linked bond market. Foreign portfolio investors are simply not set up for the quarterly indexation of cash flows to cater for Australia's internationally anomalous lower frequency CPI. Bullock told the Anika Foundation lunch that they will continue to monitor the quarterly CPI series while the full monthly series beds down and they get a better sense of its behaviour.

RBA comms

Bullock was also asked about speeches and other public appearances on the part of MPB members, as recommended by the RBA review, saying this was still a work in progress. She reiterated that MPB members would not front-run MPB deliberations.

At least one commentator has suggested that the new Board arrangements have given rise to a communications problem evidenced by the market being wrong-footed by the July cash rate decision. That is a misreading, not least because there were several occasions under the previous Board arrangements when an overwhelming market consensus turned out to be mistaken ex post.

The fact that the Board split with the first outing of the new arrangements for recording a non-attributed voting record in the event the MPB fails to reach a consensus is a good sign of greater contestation in monetary policy decision-making, a key objective of the RBA Review recommendations. Those recommendations got surprisingly little love from economists and commentators, but I think the evidence is already in that we have a much better process. Whether this leads to better outcomes is a judgment that can only be made in years to come. Stabilising the level of nominal GDP around a long-run trend growth path is a good benchmark for success.

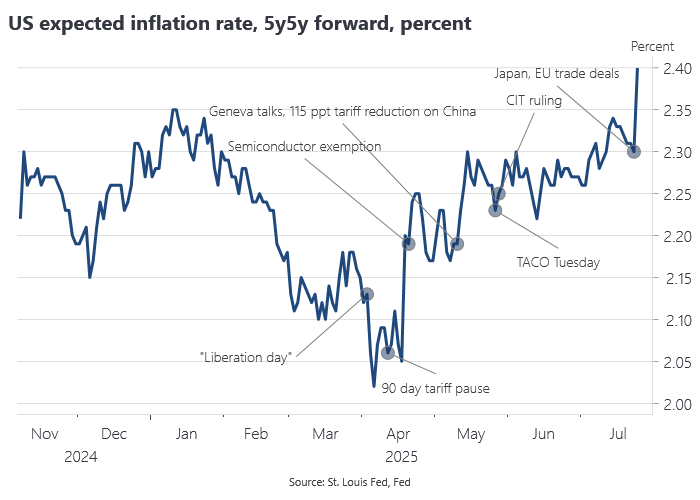

The August TACO value pack

The Trump administration claims to have landed trade deals with Japan and the EU, yielding new ‘reciprocal’ tariff rates of 15% for US imports from both instead of threatened rates of up to 30%. The two announcements provide further data points for our high frequency narrative identification of the inflationary effects of tariffs. Once again, relief on the tariff front is associated with higher, not lower, inflation expectations, implying the assumed impact of tariffs on growth is more significant than its impact on inflation. Note that 2.4% on the 5y5y forward expected inflation rate translates to around 2% on the target PCE measure. So inflation expectations remain target consistent, but only just.

The EU and Japan deals might be thought to validate Richard Baldwin's predictions of an August TACO deluge. But it is worth recalling the text of Trump's letters: 'These Tariffs may be modified, upward or downward, depending on our relationship with your Country.' As we have argued before, contrary to Baldwin, it is the uncertainty that matters more than the tariff rate.

Oral arguments in the expedited hearing of the Trump administration's appeal against the Court of International Trade ruling enjoining the IEEPA tariffs are scheduled for 31 July. This will reportedly cover both the broader collective challenge and a related case from the DC District Court brought by small toy companies. The Federal Circuit will consider both statutory and constitutional questions: does IEEPA permit any tariffs, and if so, did these particular tariffs exceed the authority or violate the nondelegation doctrine? The en banc review suggests the court may provide a definitive answer. If the Federal Circuit affirms the CIT, Trump’s IEEPA tariff program would be declared unlawful, although the decision is not necessarily a binary one: some but not all of the tariffs could be upheld. Given the constitutional questions involved, it would seem likely to go to the Supreme Court either way.

An interesting wrinkle is that, if the tariffs are ultimately invalidated, US importers could claim a refund of the tariff revenue paid to the government even if the tariffs were passed on to consumers as higher prices. Economists always distinguish between the statutory and the economic incidence of a tax, but in the case of refunds, who writes the cheque to the government really does matter. Not surprisingly, rent seekers close to the administration are lining up to take ownership of any possible windfall at the expense of US consumers.

ICYMI

Michael Pettis mixes accounting identities and economic arguments and treats prices as irrelevant.

Chris Waller not shy about putting his hand up for Powell's job.

It was a big week for prediction markets. The US CFTC was permanently enjoined from seeking to close PredictIt. The judge ruled the CFTC's actions were ‘arbitrary and capricious and otherwise legally insufficient.’ Meanwhile, Polymarket acquired derivatives exchange QCX and the affiliated clearinghouse QC Clearing, giving it a regulated US entity to begin offering contract betting in the US.

Wealth taxes: high risk, unworkable and anti-growth.

Trump’s Fixation With Greenland Has Ended Denmark’s Love Affair With the U.S.

Former Australian Treasury Secretary John Stone has died at the age of 96. I probably disagreed with John on specific issues more often than not, but learned you had to be very sure of your own case to have even a remote possibility of winning an argument with him.

glad to see someone's using that package!

Wild that uncertainty is mentioned more than in 2020